Donating Real Estate Tax Issues

- Dapatkan link

- Aplikasi Lainnya

People typically get confused with the time period actual state and real property Business. Actual property itself is just not related to business as it represents a property of land and constructing that too, including the natural sources, corresponding to flora, fauna, crops, parks, pools etc. which might be immovable and lies within the property's premises. Whereas real property enterprise is the career of selling, shopping for or renting these properties.

It's a tough activity to match the needs of buyer and property sellers, as buyer might not get his dream property and on the identical time the vendor also might not get the value of his wish. To determine a great connection between buyer and vendor and to seek out the appropriate buyer for a seller and vice versa, Real Estate Brokers might be hired which can be easily obtainable out there. Real estate brokers or agents are those, who acts as an intermediate between property purchaser and vendor and tries his stage best to match their demands. Patrons for buying and property owner for renting or promoting their property get in touch with the agent. The agent listens to their demands and take a look at onerous to satisfy them, for a property sold or rented in his supervision, the agent prices some % of the value of that property from each the events, i.e. the proprietor and the customer. Agents use websites to advertise the sale of properties, usually work at nights and weekends busy in exhibiting properties to consumers.

Ad Irs Tax Issues Search Now. Donating noncash capital gain property to charity The beauty of this tax benefit is twofold.

Tax Season Doesnt Have To Be A Yearly Struggle Knowing What You Need To Prepare Can Make Tax Season A Bree Tax Prep Checklist Tax Prep Business Tax Deductions

Tax Season Doesnt Have To Be A Yearly Struggle Knowing What You Need To Prepare Can Make Tax Season A Bree Tax Prep Checklist Tax Prep Business Tax Deductions

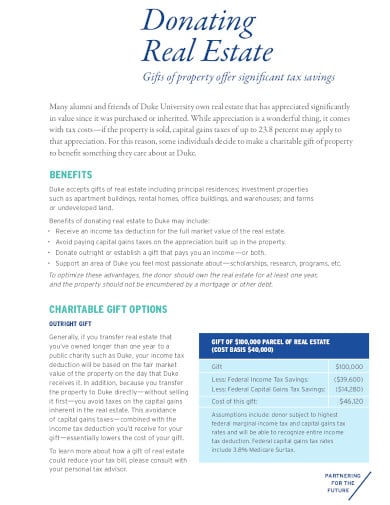

The limit increases to 60 of AGI for cash gifts while the limit on donating appreciated non-cash assets held more than one year is 30 of AGI.

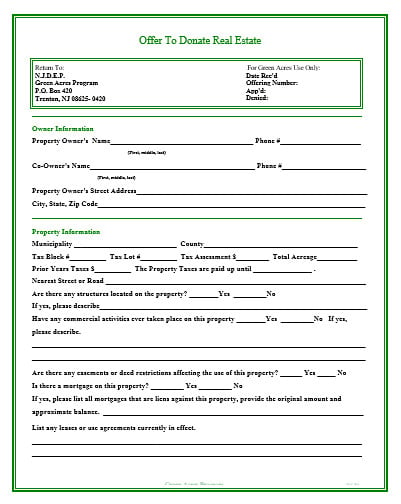

Donating real estate tax issues. 6122017 To prevent over-valuation real estate donations over 5000 require a qualified appraisal of the property performed by a qualified appraiser. First a taxpayer doesnt have to donate cash to support a charity so something originally purchased for personal reasons such as a vacation home or land used for hunting can make a difference when the taxpayer is no longer using it. 912018 Land developers often donate land back to a city or state so it is important to be prepared to make sure taxpayers get the full benefit for the donation.

That can often mean a 20 larger donation and deduction. Donating bitcoin directly can benefit both the donor and the nonprofit by bypassing the capital gains tax. You can deduct the full fair market value of the donated property.

Acknowledgement for each donation of real property as required by the IRC and the donee must also complete certain other IRS tax forms. 212011 At the time of the donation the lake house was appraised at 76000 for which the taxpayers claimed a charitable deduction on their income tax return. If the value of the real estate you donate is 500000 or more the appraisal must be attached to your tax filing.

Accommodating Staffs Will Help You With Any Inquiries. 9232020 Gifts of donated property clothing and other noncash items have long been an important source of revenue for many charitable organizations and a popular deduction for taxpayers. A Real Estate Donation vacant land house industrial residential land contracts commercial property or timeshare provides donors the means to enjoy what may be a substantial tax deduction all at the cost of helping others.

Over 85 Million Visitors. These rules may apply if the donated real property is owned in your own name with your spouse or other persons Please check with your tax professional. Every piece of real property is uniquely complex and every.

Ad Leading Real Estate Servicing All Of Bundaberg And The Surrounding Regions. A tax consultant or attorney should be consulted for advice with respect to tax documents necessary to accept a donation of real property. Your deduction may be disallowed if you dont have the appropriate documentation.

Ad Taking care of your taxes properly will be extra important this year. Ad Irs Tax Issues Search Now. A person has a lifetime gift and estate tax exclusion up to 12 million 18 million for married couples based on current IRS regulations.

Make sure youve covered all your bases with our most important tax tips. This means that. Get In Touch With Us Now.

5212020 Overall deductions for donations to donor-advised funds are generally limited to 50 of your adjusted gross income AGI. Your cost basis would be 100000 even if the property is now worth 350000 if the deceased purchased the property for 100000. The IRS denied the deduction contending that the taxpayers contemplated and received a substantial benefit in exchange for the contribution namely demolition services.

The American Jobs Creation Act of 2004 created additional reporting requirements for individual taxpayers making noncash charitable contributions. Ad Leading Real Estate Servicing All Of Bundaberg And The Surrounding Regions. Make sure youve covered all your bases with our most important tax tips.

Over 85 Million Visitors. When Real Estate Is Given as a Gift Your cost basis would be the same as the donors cost basis if you received the property as a gift during the donors lifetime because theres no step-up in basis. Ad Taking care of your taxes properly will be extra important this year.

Accommodating Staffs Will Help You With Any Inquiries. 10122020 Similar to other property donations that means the donor does not have to pay the capital gains tax they would otherwise owe and claim a fair market value deduction. The lesson from this case is that land owners must be able to prove that the increase in value to their land was only incidental as a result of their charitable contribution.

Get In Touch With Us Now. If you have held the property for more than one year it is classified as long-term capital gain property.

Pin On Wedding Planner Business Tips

Pin On Wedding Planner Business Tips

14 Free Real Estate Donation Templates In Pdf Word Free Premium Templates

14 Free Real Estate Donation Templates In Pdf Word Free Premium Templates

2021 Car Donation Tax Deduction Answers Irs Car Donation

2021 Car Donation Tax Deduction Answers Irs Car Donation

Issues To Consider In Rights Of First Refusal Ward And Smith P A

Issues To Consider In Rights Of First Refusal Ward And Smith P A

What To Do When A Commercial Real Estate Tenant Files For Bankruptcy This Or That Questions Question Mark Make A Donation

What To Do When A Commercial Real Estate Tenant Files For Bankruptcy This Or That Questions Question Mark Make A Donation

14 Free Real Estate Donation Templates In Pdf Word Free Premium Templates

14 Free Real Estate Donation Templates In Pdf Word Free Premium Templates

Transferring Property Ownership Pros Cons Other Options

Transferring Property Ownership Pros Cons Other Options

14 Free Real Estate Donation Templates In Pdf Word Free Premium Templates

14 Free Real Estate Donation Templates In Pdf Word Free Premium Templates

14 Free Real Estate Donation Templates In Pdf Word Free Premium Templates

14 Free Real Estate Donation Templates In Pdf Word Free Premium Templates

Kak Poluchit Kredit Na Stroitelstvo Zagorodnogo Doma Tax Deductions Property Prices Real Estate Articles

Kak Poluchit Kredit Na Stroitelstvo Zagorodnogo Doma Tax Deductions Property Prices Real Estate Articles

The 1 Rule For Real Estate Investing Real Estate Investing Investing Real Estate Checklist

The 1 Rule For Real Estate Investing Real Estate Investing Investing Real Estate Checklist

14 Free Real Estate Donation Templates In Pdf Word Free Premium Templates

14 Free Real Estate Donation Templates In Pdf Word Free Premium Templates

Real Estate Tax Frequently Asked Questions Tax Administration

Real Estate Tax Frequently Asked Questions Tax Administration

Donate Real Estate Real Estate Donation Tax Deduction Donation Form

Donate Real Estate Real Estate Donation Tax Deduction Donation Form

/How-Is-the-Gift-Tax-Calculated-3505674-v2-HL-cf2d3bd9ac04413ba108e6b0a44f0f39.png) Gift Tax How Much Is It And Who Pays It

Gift Tax How Much Is It And Who Pays It

Transfer Of Property In Singapore Singaporelegaladvice Com

Transfer Of Property In Singapore Singaporelegaladvice Com

14 Free Real Estate Donation Templates In Pdf Word Free Premium Templates

14 Free Real Estate Donation Templates In Pdf Word Free Premium Templates

French Inheritance Law Inheritance Rights In France Notaries Of France

French Inheritance Law Inheritance Rights In France Notaries Of France

/f/78141/4425x2538/2c94d8d1f5/kyle-mills-9afztdwrsbc-unsplash.jpg) Make A Gift Of Real Estate Giving To Stanford

Make A Gift Of Real Estate Giving To Stanford

Though brokers are such a bliss to those who are struggling to get a property or a price of their interest, but we've got to be clever relating to selecting an agent. Agents will not be bound to point out you greatest properties or tell you all of the things they know, they may get grasping sometime and present you properties which are going to profit them greater than you. Then again, for property house owners they might end up, leaving you with paying visitor that may hassle you in future, in truth, as the final aim of an agent is to promote the property as quickly as attainable, they could excite you and ask you to promote your property at comparatively lower costs than that you simply anticipated, and could be getting after some days. It's higher really helpful to choose your agent and the other celebration to purchase or sell wisely, after taking your time, and to not get excited on each different give you get.

Now-a-days many online websites and applications have been developed to remove the work of brokers. Each the events contact with one another straight and choose the offers of their curiosity. Though, this move has elevated the transparency between each the events, however due to being fully online, may lead to deceptive each other. That's why it is highly recommended to see the property in individual earlier than booking it. As the factor that seems to be good and satisfying on-line will be completely opposite from that what you'll be getting in real.

Komentar

Posting Komentar